The Investor-Grade Sector Intelligence Review on identifiers 9785526118, 525696624, 9547459648, 570020014, 505724234, and 1171060493 presents a meticulous analysis of various financial sectors. It offers a detailed examination of market trends and sector performance, highlighting both emerging opportunities and inherent risks. Such insights are crucial for investors aiming to navigate the complex investment landscape. However, understanding the implications of these findings warrants further exploration into strategic recommendations and potential outcomes.

Overview of Market Identifiers

Market identifiers serve as essential tools for investors, facilitating the accurate classification and tracking of financial instruments across various sectors.

Their significance lies in enhancing the understanding of market trends, allowing stakeholders to make informed decisions.

Sector Analysis and Insights

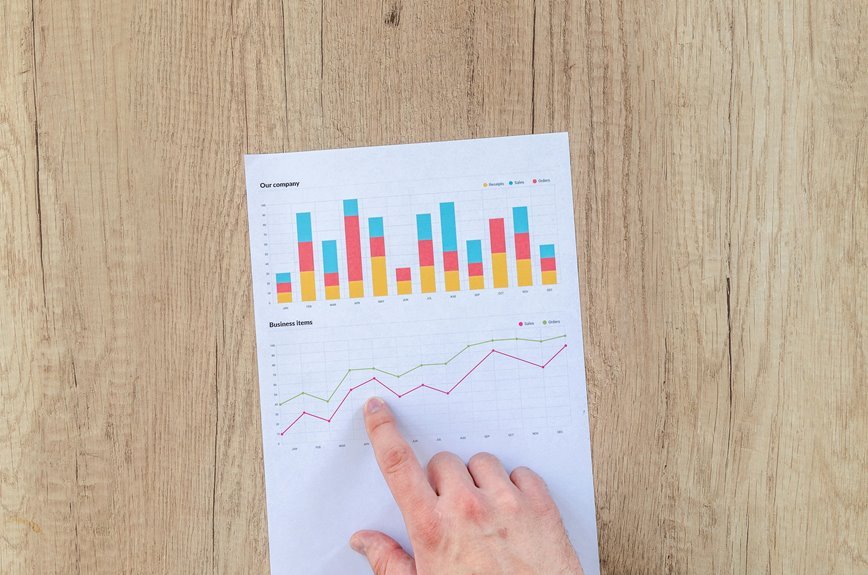

Understanding market identifiers lays the groundwork for a thorough sector analysis, enabling investors to dissect and interpret sector-specific trends with precision.

By evaluating the competitive landscape, stakeholders can identify key performance indicators and emerging opportunities.

This data-driven approach empowers investors to make informed decisions, facilitating a nuanced understanding of sector trends that directly impact investment strategies and long-term growth potential.

Investment Opportunities and Risks

While navigating the complex landscape of investment opportunities, it is essential for investors to recognize both potential rewards and inherent risks associated with various sectors.

Emerging trends, such as technological advancements and sustainability initiatives, present lucrative prospects. However, a thorough risk assessment is crucial, as market volatility and regulatory changes may impede growth.

Investors must balance optimism with caution to make informed decisions.

Strategic Recommendations for Investors

A comprehensive analysis of current market conditions reveals several strategic recommendations for investors aiming to capitalize on sector-specific opportunities.

Implementing diversification strategies across various asset classes can mitigate risk while enhancing potential returns.

Additionally, robust risk management practices, including regular portfolio assessments and adaptive allocation techniques, are essential for navigating market volatility.

These approaches empower investors to make informed decisions in pursuit of financial freedom.

Conclusion

In conclusion, the Investor-Grade Sector Intelligence Review offers a meticulously detailed analysis of market identifiers, equipping investors with essential insights to navigate complex financial landscapes. As the adage goes, “Knowledge is power,” and this review empowers stakeholders by revealing emerging opportunities and potential risks. With strategic recommendations grounded in comprehensive data, investors are better positioned to capitalize on market dynamics, fostering informed decision-making for sustainable long-term success.